On recent episode of Inside Economics podcast, there was a question raised whether we can get recession without layoffs. There are two parts to this question: Can we enter recession without layoffs, and can we go through recession without layoffs? I think the latter is pretty hard to achieve and it would require very mild recession, at which point it is a question whether given period actually amounted to a recession or not. It the former question which is more interesting.

So, can we enter recession without layoffs? I think the answer is not only “Yes”, but that we have already had such experience. Consider a following pair of pictures capturing labor market aggregates (first picture) and GDP with unemployment rate (second picture) in particular historical period. (On purpose I omitted the date axis, which will be revealed at the end, but bonus points for guessing it outright 😉) .

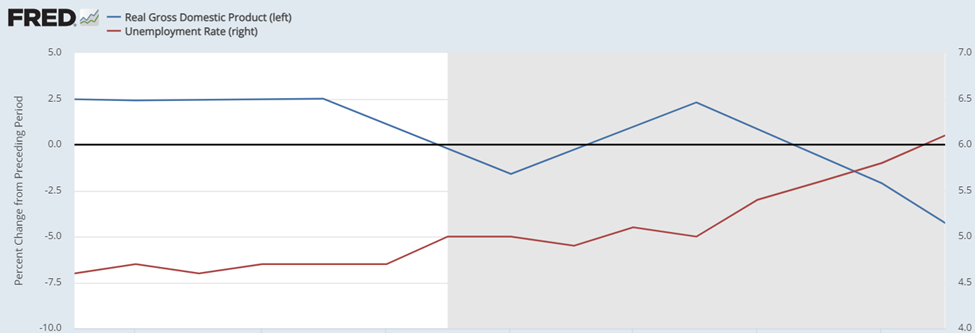

The second half of this period was officially categorized as

recession. This is not very surprising as during this time monthly hiring has

declined significantly from 5.2m to 4.5m, dragging down with it the employment,

which has declined by 1.7m from 138.4m to 136.7m. Meanwhile, unemployment rate

increased from 4.7% to 6.1%, while GDP had two quarters of negative growth

intersected by a positive quarter. Overall, this is clearly consistent with

recession, albeit not a particularly severe one.

The key point, though, is in the layoffs series, replicated

once more with slightly extended sample:

While layoffs did increase a bit, the increase was very

small amounting to 200k-300k, less than half of decline in hirings. Moreover,

this increase occurred only towards the end of our sample. Before layoffs did

not record any increase (at best they were bit elevated) while employment

already managed to decline by 0.5m.

The conclusion is simple: we have already had an experience

when we entered recession without widespread layoffs. Therefore, even if firms

will hesitate to lay off people – something that I think will be a feature of potential

2023 recession – we might enter recession in 2023. All that it would take would

is for firms to significantly decrease their hiring, something that is possible

even if they will be hesitant to let their current employees go. In such

situation employment will start to decrease and unemployment rate will start to

increase, eventually tipping us into recession. And then the layoffs will likely

come. (Indeed, one can imagine that if we do tip into recession, then the

eventual layoffs might become more aggressive then initially thought, given

that firms will be postponing layoffs for long period of time.)

So what was the period of time captured in the pictures? It was the onset of Great Recession:

Of course, after the end of the picture employment continued to tank as hiring decreased further, and more importantly, layoffs increase:

The other way to see the argument is to look at the cumulative effect of each of the flow category on the overall employment:

This shows that hires were initially the predominant source

of shortfall in employment and that layoffs really kick in only in late 2008.

Hence the conclusion that high layoffs are not necessary for unemployment to

rise and for us to enter recession, low hiring will suffice. That said, given

that this picture is quite sensitive to the choice of base date – layoffs were

somewhat elevated in November 2007 already relative to say 2006 - a more

qualified statement would be that large-scale layoffs are not necessary, low

hiring and slightly elevated layoffs will do.

This is because even in normal month there is large amount

of churn, with lot of laid-off people who quickly find new work, as long as

hiring is robust. If it is not, then people who will be laid off as part of

natural process, will not find work and will become unemployed.

No comments:

Post a Comment