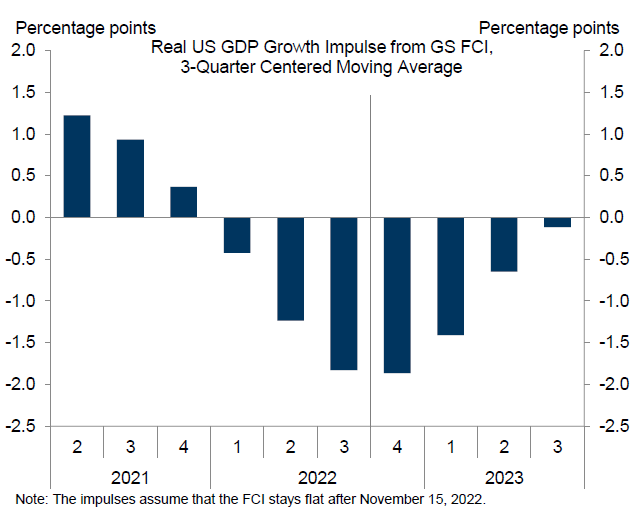

The second piece in this series is dedicated to modelling and to monetary policy. It has been motivated by this nice chart from the Goldman Sachs:

This chart is highlighting that we should not think that recession

is coming just because of the tightening we have seen already, because lot of the

effect of tightening has already been felt simply because tightening has started

almost a year ago. Which I think is important point to make and the chart is

very useful in putting numbers to this idea.

That said, after thinking about this chart I started

wondering whether it does not overstate its case. The odd thing that stroked me

was the fact that the effect of the tightening is tending to zero over time. At

first glance it does sound reasonable that after tightening ends the effect it

has should gradually become zero. And in-so-far as focusing on the process of

tightening (that is raising rates), this is just logical conclusion.

However, that is not how this graph is being used and interpreted.

The chart was being used to argue that the impact of monetary policy as such

is going to wane in coming quarters, which is a different point from the impact

of just the tightening process. The point to realize is that the end point of

tightening is relevant; in other words, if we end up with high interest rates[1],

then that should have negative effect on growth irrespective of whether the

rates are being raised further or not. In the parlance of Fed, they want to raise

rates to rates to restrictive level and keep them there. The use of word

“restrictive” implies that that high level will have continuously negative

effect on aggregate demand as long as rates are at that level. In other words, the

effect of tightening will be non-zero even after the end of the tightening

process; as higher rates stay, the effect will stay as well.

How is this all related to power of transformation? Well, in

the report where the chart was used the authors come clean and say that the

model links the effect on growth to changes in the financial conditions

index. This then leads to the conclusion that when changes in monetary policy

go to zero, the effect goes to zero. However, the choice of changes in

financial conditions as the driver of growth is not as self-evident as it might

seem. I can as plausibly argue that it is the level of financial conditions

that is relevant for growth, with high level implying lower growth. Indeed,

this is what one would take away from standard macroeconomics models.

Ultimately, the point is not that either changes or level is

the correct choice.[2] I

think it is fair to say that both matter: level is important, but rapid changes

in level can carry much bigger punch than the change in level alone would imply,

and hence changes are important too. The point is different: The story the

chart (and underlying model) say is really a function of the choice of transformation;

if different transformation would be used, the story would be completely

different. Hence the power of choice of transformation.

[1]

High of course needs a benchmark, as in high relative to what. Here I mean high

relative to (long-term) neutral rates.

[2] I

would view this view irrespective of econometric arguments. For example, I am

pretty sure the authors chose changes in financial conditions index either

because they concluded that the series

has a unit root, or because they concluded that it fits better. Neither of

these would persuade me that this is the only correct perspective.

No comments:

Post a Comment