The first thing to realize that at this moment failure of

SVB is a failure of single financial institution. And while SVB was not a small

bank - with north of 200 billion in assets it ranked as 16th largest

in the US – neither it is a large-enough bank for it to be systematically

important. To realize this, notice that it felt under both the more strict (250

billion) and even the more relaxed (500 billion) threshold for participation in

annual Federal reserve stress test exercise. Therefore, in isolation, its

failure does not pose a threat to the financial system. The question, though,

is what does this imply for the rest of the financial system.

Of course, this is impossible to know with certainty. In

such situation, it is useful to spell out possible scenarios, and try to assign

(necessarily subjective) possibilities to each scenario.

Nothing happens

Option 1 is that this will be fully self-contained to SVB,

and then after few days financial markets realizing the limited nature of the

situation will move on. There are many reasons for this case. First, SVB was

clearly unique among large(r) banks in terms of its vulnerability. On asset

side, it had unhedged interest rate exposure, while other large banks have

their interest rate exposure hedged away, something that is a public knowledge.

On liability side, SVB was funded by uninsured short to much bigger degree than

other banks, partly due to its rapid growth, as its assets quadrupled since start

of the pandemic. Moreover, the depositors were from relatively tightknit community,

which meant that the news about weak position of the bank spread very quickly

among its depositors, with some of the voices of the community, such as Peter Thiel

acting as amplifiers. We know that such conditions make run by depositors much

more likely.

In other words, SVB was uniquely vulnerable among large(r)

banks, both on asset and liability side. And this uniqueness might mean that its

failure will be a one-off and no other banks – or at least no other banks with

any meaningful size – face pressures and fail. There are ample precedence for

isolated failure of non-systemic bank in situation when other banks do not

share its vulnerabilities on asset and liability side.

Likelihood: 20-25%

Tremors without casualties

While SVB was unique among large(r) banks, it does not mean

that many of the small and medium banks do not face similar problems. Over last

couple months there were news of this bank segment in the US facing funding

pressures related to rising interest rates and associated outflow of funds, as

depositors opted for higher yielding government money markets.

Moreover, whether SVB was unique or not really is subjective.

It is entirely plausible that depositors will consider SVB more similar to

other banks, especially Californian banks. Indeed, there are signs of troubles

at few other medium-sized banks with similar profile as SVB. This could mean

that small or large share of depositors decide to pull their money from these

banks.

What happens after that really depends on the scale of fund

outflow. If it is relatively small, possibly limited by appropriate noises from

government and regulatory officials, then this pressure could eventually die

without claiming any other casualties. This is especially likely if the

resolution of SVB is favorable to its depositors.

Likelihood: 25-30%

Some casualties, but situation remains contained

On the other hand, if the resolution of SVB is unfavorable

to uninsured depositors – or only eventually favorable, with doubts about their

fate in coming days/weeks – then the likelihood that the pressure on other small

and medium banks yields further casualties is large. However, this does not

mean that things will get out of hand. It is very plausible that after few bank

failures the situations calms down, as

financial markets and depositors realize that the problems are limited to few

institutions rather than widespread. Or alternatively, after some period

regulators and government officials come up with a forceful action. In essence,

this scenario amounts to weeding out the weakest banks without ramifications

for the rest of the financial system, something that we have also seen before. This

is in line with academic literature that suggests that it is the weaker banks that

typically fail.

This and previous are the most likely scenarios: for things

to get out of hand and us to end up with more or less limited financial crisis,

it is not enough for one bank to fail (as long as it is not central to the

financial system). You need the wider financial system to face the same vulnerability,

either on asset or on liability side, or both. While there are some shared

vulnerabilities on asset side, as far as we know, these rather limited. And on

liability side the wider banking system is in very different situation, with large

amounts of excess reserves. And on top of everything, the large systematic

banks are very well capitalized, as far as we know.

Likelihood: 25-30%

Contagion which is eventually contained

While direct implications from SVB failure is limited, and its

vulnerabilities are not shared by the wider financial system, one cannot rule

out that the wider financial system will be affected. The most likely reason

for this to happen is for the resolution of SVB to be unfavorable both to bond

holders and uninsured depositors., This could plausibly be because of limitations

on interventions from regulators and the Fed imposed by the new regulatory

rules after the global financial crisis. This could sawn doubt into bond holders

and depositors about the backstop offered to other institutions in case they get

into trouble. As a result, they could pull to safety of either other

instruments or larger, safer institutions. And like that the crisis would start

to spread to wider financial system.

In such an event it is likely that an action to stop the

contagion would eventually come. The typical script of financial crisis is

gradual encroachment of the crisis onto wider and wider circle institutions until

the pain becomes too large for the political system and there is resolute

action. Plausibly, this time around this would come much sooner than it did in

2007-2008 – the action during pandemic showed that with large financial crisis

in recent memory, the point when political establishment acts is significantly

earlier than otherwise.

Likelihood: 10-15%

Gradual escalation to full blown financial crisis

Despite all this, things could get evolve into full blown

financial crisis. Financial systems always seem resilient until they are not. It

is possible that the problems of SVB are more widely shared, or that the repercussions

of its failure will reveal vulnerability we do not know of. If the global

financial crisis taught us something it is that there are parts of financial

system which are little known until they blow up. In the same way, we might be

sitting in front of ticking bomb and not know about. While plausible, this

remains rather unlikely.

Moreover, we are clearly in early stages of developments, so

even if we were to go there, it would take at least couple months of gradually

worsening situation. The analogy of SVB to the 2007-2008 period is the early

failures of summer 2007, and especially the Northern Rock episode. Northern Rock

was actually very similar in many ways: the rapid growth prior to failure, the

reliance on short-maturity liabilities, and only limited problems on asset

side. Both SVB and Northern Rock were vulnerable because of their funding

structure rather than because of the asset side of their balance sheet. If this

analogy is suggesting something, then it is that even if this will become something

serious, we would need to go through the gradual escalation, that would take

months, if not longer.

Likelihood: 2-5%

Macroeconomic implications

If SVB will prove to be a standalone, then the story will be

soon confined to historical textbooks and will not have any ramifications on

wider macroeconomy, beyond likely making Federal reserve more cautions and

opting for 25bps hike on Wednesday, rather than 50bps hike which was the

baseline as of Thursday morning.

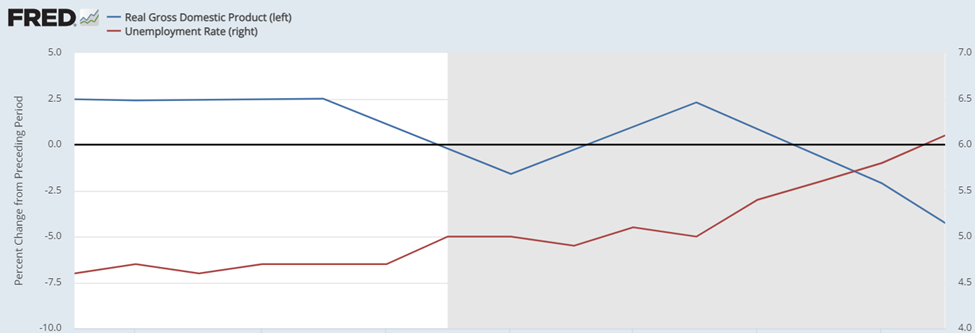

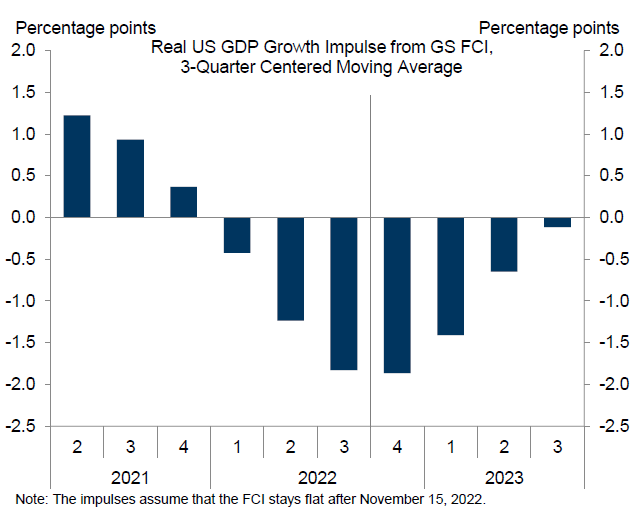

If it leads to pressure on other banks but no other

failures, then the implications would be very similar, albeit it might lead to

tightening of financial conditions and weakening of the economy sometime down

the road. The implications for immediate monetary policy would be again

limited, albeit the hiking might stop one or two meetings sooner then otherwise.

This is more likely under the scenario where there will be

other failures, but things will not get out of hand. Depending on the speed of

developments, this could mean that March hike is the last one by the Fed, while

ECB will very likely make at least one more hike in this scenario.

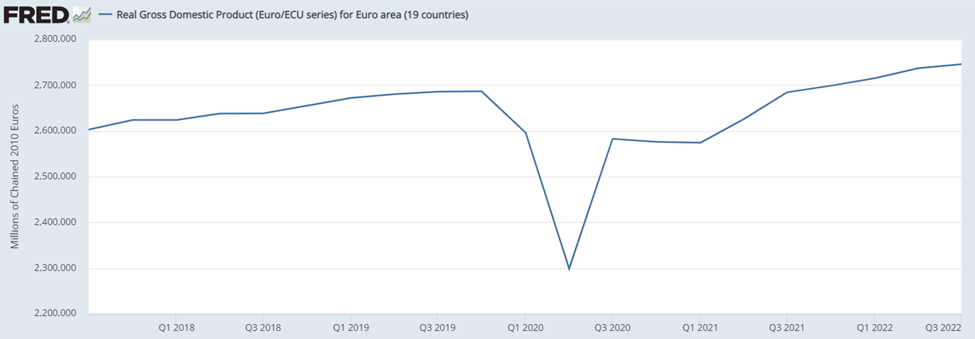

What if this continues to gradually escalate? Assuming that

things don’t worsen rapidly it would likely mean recession later this year and corresponding

rate cuts. This means that only rapid escalation, which remains rather

unlikely, could mean that the ECB would stop hiking already in May. Rather,

this puts into question the hike in June and July, and has implications for

size of hike in May.